Aadhar Housing Finance Ltd

Hyderbhad - 509209

Give a missed call on

Get in Touch

Simply drop in your name, mobile number with us and our home loan officer will get in touch with you!

- Home Loan for Salaried Employees

- Home Loan for Self-Employed

- Loan For Plot Purchase & Construction

- Home Improvement Loan

- Home Extension Loan

- Loan Against Property

- Balance Transfer & Top-Up

- Home Construction Loan

- Loan For Plot Purchase

- Loan for Construction of Non-Residential Property

- Aadhar Gram Unnati

- Home Loan for Salaried Employees

- Home Loan for Self-Employed

- Loan For Plot Purchase & Construction

- Home Improvement Loan

- Home Extension Loan

- Loan Against Property

- Balance Transfer & Top-Up

- Home Construction Loan

- Loan For Plot Purchase

- Loan for Construction of Non-Residential Property

- Aadhar Gram Unnati

Key Benefits of Your Loan

Home loans available without

income proof

Loan tenure: up to

30 years

Eligibility starts from

₹10,000 monthly income

Fast and transparent

loan procedure

Affordable

EMIs

Tax benefits under

section 80C

Map

Our Products

Home Loan for Salaried Employees

Turn your dream home into reality with Aadhar's tailored Home Loan solutions for Salaried Employees! With a monthly salary eligibility of just ₹10,000, our loans cater to diverse income levels. Avail up to ₹1 Crore, with 80% financing of the property's registered cost or market value. Our loan tenure extends up to 30 years for bank salaried and 20 years for cash salaried. Get a personalized loan amount assessment based on factors like age, income stability, educational background, and more. Use our loan eligibility calculator for a quick estimate. Enjoy flexible loan terms, attractive interest rates, and a hassle-free application process. Our dedicated team will guide you through the application process, ensuring a smooth journey to homeownership. Apply now and take the first step towards owning your dream home! Explore our website or visit our nearest branch for expert guidance on home loan eligibility, interest rates, and the best home loan for salaried employees.

Home Loan for Self-Employed

Empowering self-employed individuals to own their dream homes, Aadhar Housing Finance offers tailored Home Loans with flexible terms. We understand the unique challenges of irregular income and lack of formal financial proof and have developed specialized processes to assess income and offer fair loan terms. Avail loans up to ₹1 Crore, with 80% financing of property cost (75% for loans exceeding ₹75 Lac). Our loan eligibility calculator helps determine your sanction amount based on factors like repayment capacity, experience, and business stability. A minimum of 3 years experience in the same field is required. Enjoy flexible loan tenure of up to 20 years, with EMI calculations based on interest rate, tenure, and loan amount. Use our EMI calculator for a quick estimate. Apply now and take the first step towards owning your dream home, with Aadhar's expert guidance and support. Our dedicated team will help you navigate the self-employed mortgage application process.

Loan For Plot Purchase & Construction

Build your dream home on your chosen plot with Aadhar's Loan For Plot Purchase & Construction. Finance up to ₹1 Crore for plot purchase and construction, with 60% of plot cost and 80% of construction cost. The overall loan amount is capped at 80% of the property's market value (75% for loans above ₹75 Lac). Construction must occur within the plot and adhere to NHB guidelines. The loan amount is determined based on individual requirements, repayment capacity, and factors like age, income stability, dependents, assets, liabilities, and savings habits. Use our loan eligibility calculator to determine your sanction amount. Enjoy flexible loan tenure of up to 30 years for bank-salaried and 20 years for cash-salaried and self-employed individuals. Calculate your EMI using our EMI calculator, based on interest rate, loan amount, and tenure. Apply now and turn your dream home into reality with Aadhar's home loan for land purchase and construction.

Home Improvement Loan

Transform your home into a reflection of your personality with Aadhar's Home Improvement Loan. Avail up to ₹1 Crore for various renovation purposes like flooring, plumbing, electrical work, painting, and more. The loan amount is capped at 100% of the estimated renovation cost or 80% of the property's market value (75% for loans above ₹75 Lac). Use our loan eligibility calculator to determine your sanction amount. Enjoy flexible loan tenure of up to 30 years for bank-salaried and 20 years for cash-salaried and self-employed individuals. Calculate your EMI using our EMI calculator, based on interest rate, loan amount, and tenure. Apply now and give your home the makeover it deserves with Aadhar's expert guidance and support. Our home improvement loans are designed to help you create your dream home, with flexible repayment options, personalized service, and quick disbursement. Turn your vision into reality with our home renovation loan.

About Aadhar Housing Finance Ltd

Aadhar Housing Finance Ltd (Aadhar) is one of the largest low-income housing finance companies in India servicing the home financing needs of the low income sections of the society. Aadhar endeavours to empower underserved millions to own their first homes.

₹ 21121 Cr

Assets Under Management (AUM)

266000+

Happy Customers

534+

Locations across 20 States & Union Territories

Your Home Loan in 4 Easy steps

Step 1

Assessment

Step 2

Conditional Loan Sanction

Step 3

Security Assessment

Step 4

Loan Disbursement

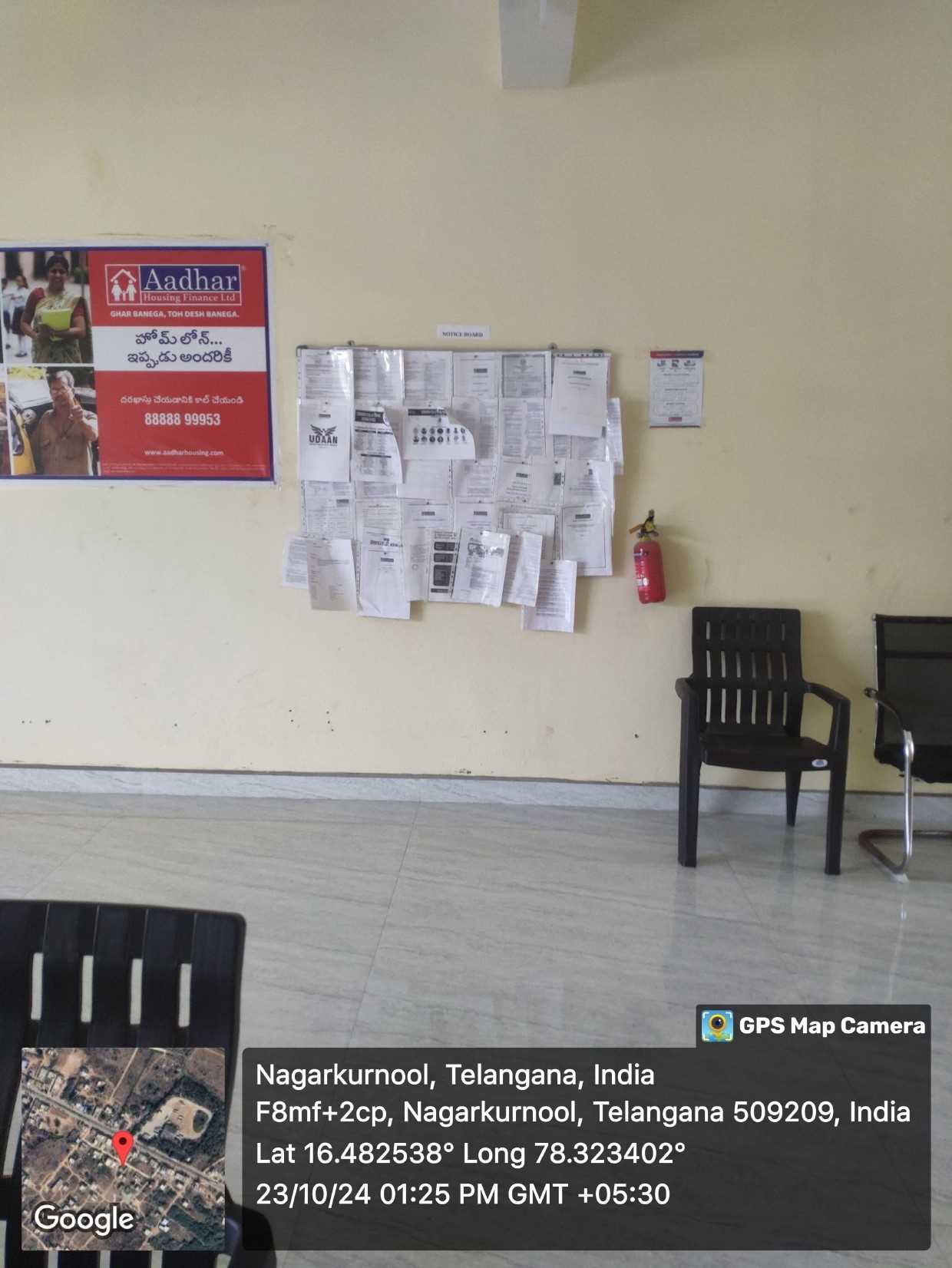

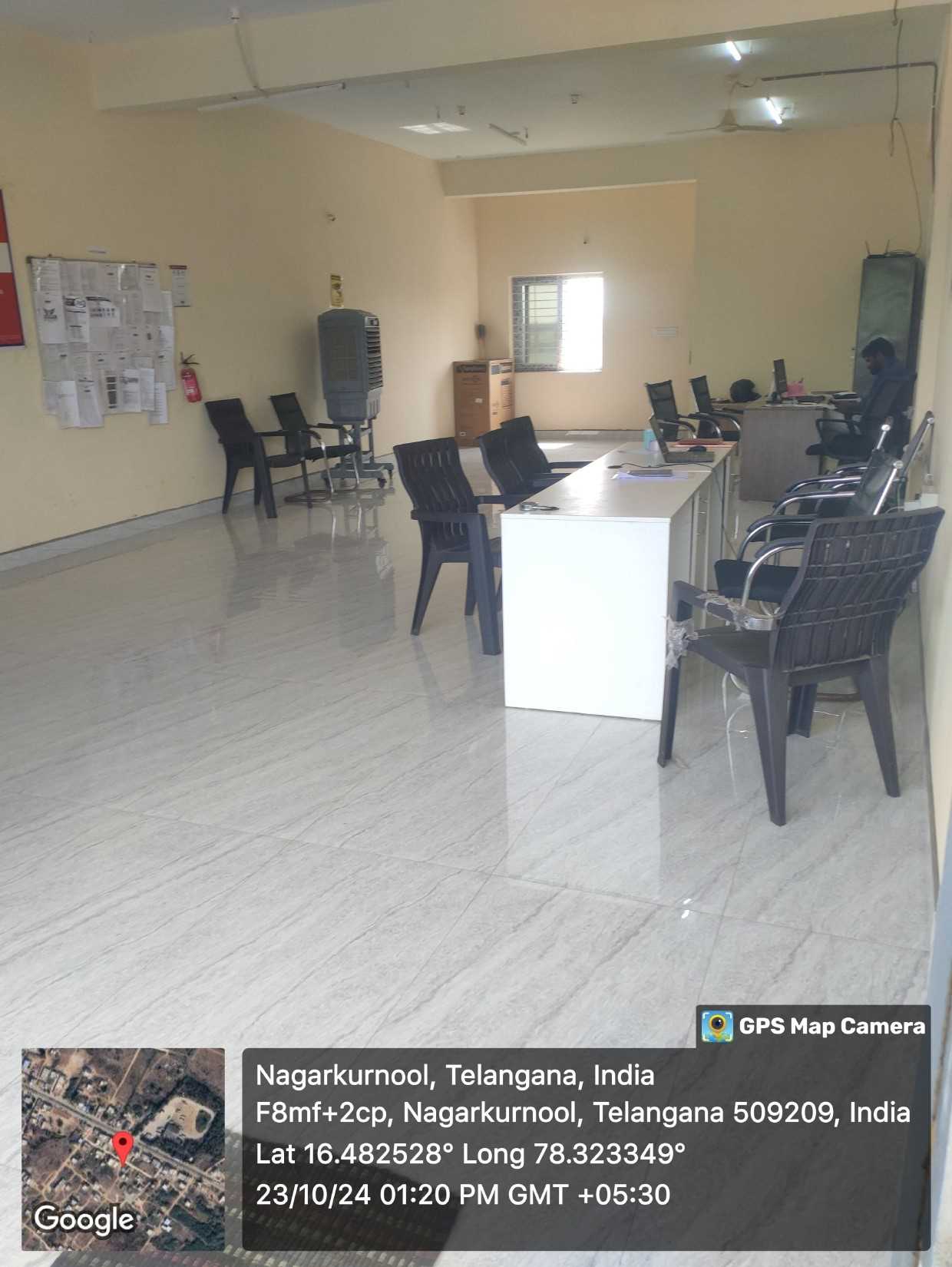

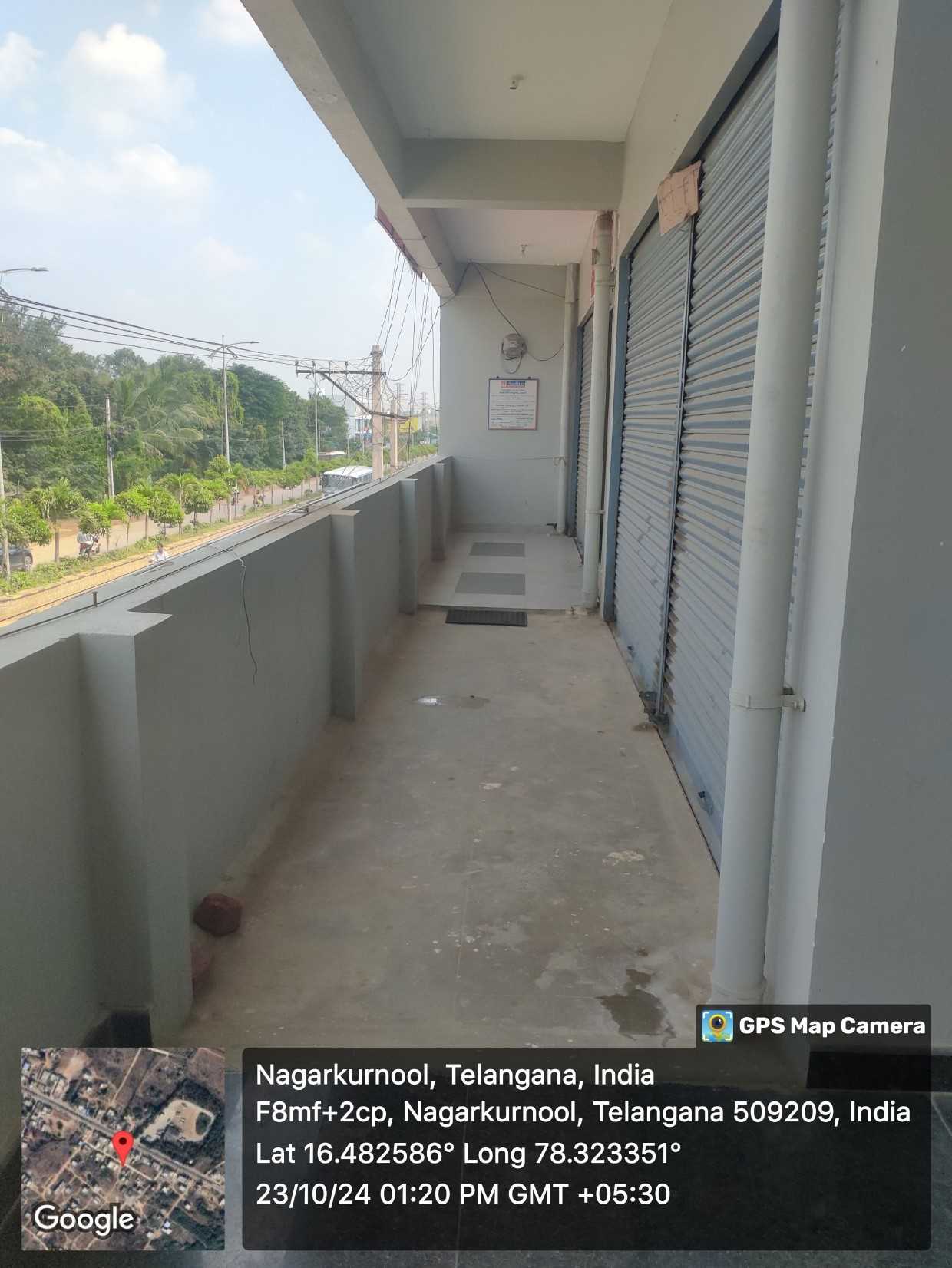

Photos

Nearby Branches

Kalwakurthy - 509324

Wanaparthy - 509103

Mahabubnagar - 509001

Gadwal - 509125

Shadnagar - 509216

Business Hours

- Monday - Saturday: 9:30 AM - 6:30 PM

Payment Methods

- Cash Payment

- Net Banking

- Debit Card

- UPI

- QR Code Payment

- RTGS and NEFT Transfer

Categories

- Construction Finance

- Home Improvement Loan

- Housing Loan

- Loan Against Property

- Residential Plot Loan

- Top Up Loan

Tags

Aadhar Home Finance Near Me

Property Loan

Housing Finance Companies

Home Finance

Ahfl Branch Near Me

Home Loan In Nagarkurnool

Property Loan

Housing Finance Near Me

Aadhar Finance Near Me

Loan For Plot Purchase

Home Renovation Loan

Non Residential Property Loan

Home Improvement Loan Interest Rates

Home Loan In Hyderbhad

Latest Blogs

This Buddha Purnima, Aadhar Housing Finance wishes you a life filled with peace, wisdom, and lasting happiness! Let this sacred day inspire you to grow with purpose, live with intention, and build a future grounded in harmony. Wishing you and your family a blessed and serene Buddha Purnima.

Every dream home needs a hero — and that hero could be you! At Aadhar Housing Finance, we believe that everyone deserves a place to call their own. No matter where you are in your journey — starting fresh, growing your family, or building a future — we’re here to help you unlock the missing piece: your very own home. With easy loan processes, personalized guidance, and affordable EMI options, Aadhar Housing Finance walks with you every step of the way. Visit your nearest Aadhar Housing Finance branch today and take the first step toward homeownership!

Now enjoy your home on the path of peace and love with Aadhar Housing Finance. May the teachings of Lord Mahavir inspire a life filled with compassion, truth, and harmony. Aadhar Housing Finance extends warm wishes to you and your family on this sacred occasion. Best wishes on Mahavir Jayanti.

Healthy communities build a stronger India. From mobile clinics to child nutrition, Aadhar Housing Finance supports wellness at every step. This World Health Day, we celebrate care, access, and dignity for every life we touch.

Catch the Ghibli vibes as you embark on a magical journey to your dream home! At Aadhar Housing Finance, we make homeownership simple, accessible, and hassle-free, with our easy home loans so you can focus on creating new beginnings in a place you truly call your own. Let’s turn your dream home into reality—because every great story starts with a home!

The joy of Eid is best celebrated in the warmth of home, where love, laughter, and togetherness create cherished memories. Just like the sweetness of Eid, a new home brings comfort, security, and happiness to your family. At Aadhar Housing Finance, we are committed to helping you turn your dream of owning a home into reality, ensuring a brighter and more secure future. Eid Mubarak!

If your home loan needs are unique, why should your EMI stay the same? At Aadhar Housing Finance, we believe in making homeownership easier and more accessible for everyone. With our flexible EMI options, you can customize your repayment schedule to suit your financial situation, ensuring a stress-free home-buying experience. Our simple application process, quick approvals, and competitive interest rates make securing a home loan effortless. Take a step towards your dream home today with Aadhar Housing Finance’s personalized home loan solutions.

Beautifying your home is now easier than ever with the Aadhar Home Improvement Loan! Give your home a new identity with our hassle-free loan options. Whether it’s renovation, remodeling, or home upgrades, we offer affordable home improvement loans with: Easy Process Minimal Paperwork Competitive Interest Rates With Aadhar Housing Finance, your dream home is just a step away! Apply today and give your home the transformation it deserves. Visit your nearest Aadhar Housing Finance branch or contact us for more details.

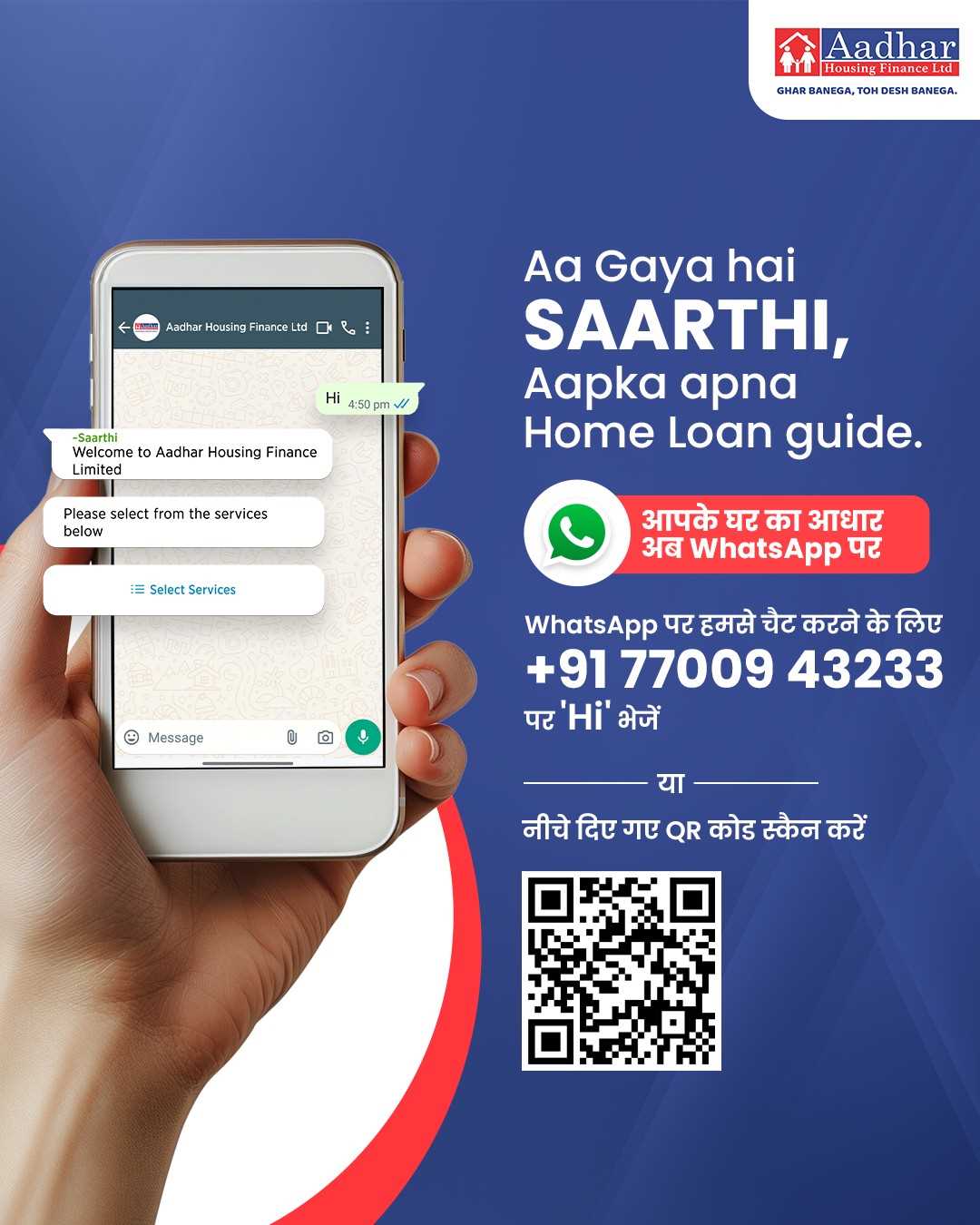

Looking for a quick, smart, and stress-free way to manage your home loan? Meet Saarthi – your 24/7 digital banking companion on WhatsApp! Whether you need help with loan applications, eligibility checks, document submissions, or EMI details, Saarthi is here to guide you every step of the way. No more waiting in long queues or navigating complex processes—just send “Hi” to our number or scan the QR code, and experience seamless, instant assistance from the comfort of your home. At Aadhar Housing Finance, we believe in making homeownership simple, accessible, and convenient for everyone. Let Saarthi take the stress out of your home loan journey and bring you one step closer to your dream home!

Celebrate Mahashivratri with new beginnings and prosperity! With the blessings of Lord Shiva, step closer to your dream home with Aadhar Housing Finance. Happy Mahashivratri.

Frequently asked Question

Aadhar Housing Finance Ltd is conveniently located at No.20-182/2/B/A/1,1st Floor,Main Rd,Nagarkurnool,Near Bhavani Hotel, Nagarkurnool, Hyderbhad. Visit our branch to explore our range of affordable housing finance solutions in Hyderbhad.

The office hours for Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad are from 9:30 AM to 6:30 PM, Monday to Friday. Please check our website or contact the branch for any holiday hours or special schedules.

You can contact Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad by calling us at 18002684040. For more information, visit our website or Google Business Profile.

Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad offers a variety of home loan products including affordable housing loans, home improvement loans, and home extension loans. We cater to both salaried and self-employed individuals in Hyderbhad.

Yes, you can easily apply for a home loan online in Hyderbhad through Aadhar Housing Finance Ltd. Visit our website to start your application or contact our Nagarkurnool branch for assistance.

The documents required for a home loan in Hyderbhad include proof of identity, address, income, and property-related documents. Visit our Nagarkurnool branch or website for a detailed list.

You can find directions to Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad by searching for us on Google Maps or visiting our website for detailed directions to our housing finance branch in Hyderbhad.

The eligibility criteria for a home loan in Hyderbhad at Aadhar Housing Finance Ltd include factors such as income, age, credit history, and property value. Contact our Nagarkurnool branch for a detailed assessment.

You can pay your home loan EMIs in Hyderbhad through various methods, including online payments, bank transfers, and auto-debit facilities. Visit our website or contact our Nagarkurnool branch for more payment options.

We value your feedback! You can leave a review for Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad on our Google Business Profile. Your reviews help us improve our services and better assist customers looking for home loans in Hyderbhad.

Parking facilities at Aadhar Housing Finance Ltd in Nagarkurnool, Hyderbhad may vary. Please contact the branch directly at 18002684040 for the most accurate information.